Some knightly context

For an initial check on how well this proposed interpretation might mesh with the greater context in which TMC appeared and its major contributions, we rely on Professor Hülsmann’s definitive intellectual biography, Mises: The Last Knight of Liberalism (2007).

First, we find that Hülsmann noted on p. 215 (emphasis mine) that:

In dealing with the nature of money, Mises relied heavily on the work of Carl Menger. The founder of the Austrian School had shown that money is not to be defined by the physical characteristics of whatever good is used as money; rather, money is characterized by the fact that the good under consideration is (1) a commodity that is (2) used in indirect exchanges, and (3) bought and sold primarily for the purpose of such indirect exchanges.

The words “good” and “commodity” as we read this passage would normally seem to point to physical characteristics, and this was most likely also the intended meaning. But what if we try reading again with abstract senses for these words in mind? The substantive points in this paragraph are all about functional characteristics of money for actors. Look for the verbs: used as, bought, and sold. Moreover, “physical characteristics” are specifically singled out as factors on which money is “not to be defined.”

In quickly reviewing Mises’s typology of monetary objects (pp. 216–217), Hülsmann notes that:

[Mises] distinguished several types of “money in the narrower sense” from several types of “money surrogates” or substitutes. Money in the narrower sense is a good in its own right. In contrast, money substitutes were legal titles to money in the narrower sense. They were typically issued by banks and were redeemable in real money at the counters of the issuing bank.

Here we have the word “good” again. We also have “a good in its own right.” This seems reminiscent of our hyper-literal attempt at rendering Sachgeld as “thing-in-itself money,” or more simply “money in itself.” So far as I am aware, Bitcoin currently has no significant substitutes and virtually no issuers of any such substitutes. Perhaps with a few arcane or experimental exceptions, Bitcoin is so far traded directlyas itself at freely fluctuating rates against all other goods, services, and monies. While the construction of Bitcoin-denominated financial instruments is possible, most all of the actually traded forms of Bitcoin are direct instantiations of bitcoin units.

As Šurda explained (pp. 9–18), Bitcoin is already inherently “form-invariant,” much as language can come in spoken and written forms, but remains language. “Transfer of Balances (ToB)” methods convey Bitcoin units from one wallet to another, while “Transfer of Keys (ToK)” methods, suited for offline use, transfer physically instantiated wallets that contain specified Bitcoin balances (effectively denominations). The private key is physically contained inside a ToK object in the shape of a coin, smart card, etc. with structural and one-time-change physical security features such as holographic coverings and color-change chemistry. Critically, the current wallet balances on ToK objects can be verified if necessary using only the public key without the need to expose the physically concealed private key to any party. None of these ToK objects are Bitcoin substitutes; they are each native forms of Bitcoin itself.

The question of whether actual Bitcoin substitutes and associated practices entailed in the kind of “banking” we are accustomed to could evolve on top of Bitcoin is a separate and open one. Šurda has also just recently offered some further observations on this in an interview with Jon Matonis in American Banker, “How cryptocurrencies could upend Banks’ monetary role” (15 March 2013).

The key issue seems to me that Bitcoin both functions as a money in itself and delivers many of the benefits of historically evolved money substitutes, leaving little demand for them to grow up in relation to Bitcoin, at least in the same old ways. In a provocative take on the question of Bitcoin money substitutes, Pierre Rochard has suggested that this type of development might simply render the ongoing debate about banking reserve practices not so much resolved as obsolete (22 February 2013). People will of course attempt to construct all such familiar instruments, but whether they can add any value relative to native Bitcoin and attract any sustained and significant use remains to be seen.

Mises, in developing his own monetary theory in TMC, was also arguing against the assignment theory of money, which holds that money has no real value of its own to actors, but merely functions as a sort of neutral receipt that facilitates deposits and withdrawals on the “social warehouse” of goods. Money, in this view, is simply a “veil,” functioning as a sort of mere claim ticket exchangeable for other goods, but not a good in itself.

On p. 237, Hülsmann explains that:

Mises’s great achievement in his Theory of Money and Credit was in liberating us from the veil-of-money myth…Mises could even rely on Menger’s theory of cash holdings, which already contained, in nuce, the insight that money is itself an economic good and not just representative of other goods.

Böhm-Bawerk had put it this way in an early-1880s lecture (p. 235):

Money is by its nature a good like any other good; it is merely in greater demand and can circulate more widely than all other commodities. Money is no symbol or pledge; it is not the sign of a good, but bears its value in itself. It is itself really a good.

Hülsmann explains the role of Mises’s strict terminology in countering the prevailing assignment theory of money (p. 237):

To combine these elements into one coherent theory required a radical break with time-honored pillars of monetary economics, in particular, with the classical tradition of presenting money as a mere veil. Mises was fully conscious that this was the key to his theory, which is why, in an introductory chapter of his book [Chapter 3], he engaged in the somewhat tedious exercise of distinguishing various types of money proper (money in the narrower sense) from money substitutes. It was these substitutes in fact that were the sort of tokens or place holders that Wieser and the other champions of the assignment theory tacitly had in mind when they spoke of money…While it is true that the value of a money substitute corresponds exactly to the value of the underlying real good (for example, one ounce of gold), the value of the gold money itself does not correspond to anything; rather it is determined by the same general law of diminishing marginal value that determines the values of all goods.

This greater context clarifies that “money in the narrower sense” is a form of money valued directly without any intermediation of substitutes and without mere veiled representational reference to other goods. Money was not just a placeholder or accounting entry, a claim ticket for other goods. It was one good trading for other goods on the market. Moreover, Sachgeld, “money in itself,” was further differentiated from Mises’s other two monies “in the narrower sense” by not being a debt instrument (credit money) and also not depending on any official legal certification or special legal status (fiat money). The primary distinction of money in the narrower sense among all other goods was its wider relative marketability, as Böhm-Bawerk had explained.

This higher degree of marketability then gives rise to an increased value of money as a hedge against uncertainty. If no uncertainty existed, there would be no need to hold cash balances. As Hoppe explains in “‘The Yield from Money Held’ Reconsidered” (2009), in the real and always uncertain world, we do not know in advance exactly what we will want to buy and when, but we do know with much higher certainty that we will want to buy something sometime. The holding of cash balances can be understood as a forward-looking measure we take in relation to this degree of perceived uncertainty.

No coinbug likes inflation

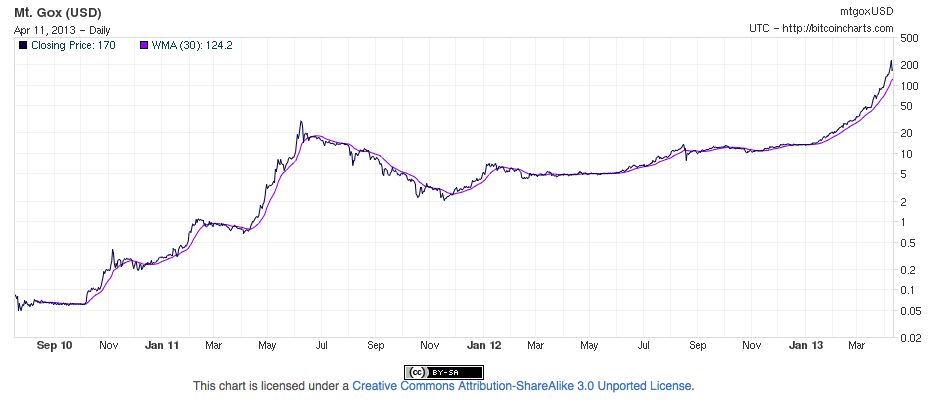

Whatever the future brings, for today, at least, Bitcoin seems to behave very much like a “money in itself,” but one unlike any the world has ever seen. It is digital and it is apparently impossible for any party to manipulate its total supply. This is critical, because one of the central political-economic monetary issues is inflation, by which I mean specifically, the ability of money producers to manipulate the money supply for whatever reasons they might happen to have in mind or cite at a given time.

As Mises wrote in TMC (p. 428):

It is not just an accident that in our age inflation has become the accepted method of monetary management. Inflation is the fiscal complement of statism and arbitrary government.

He also explained the social-protective advantages of having precious-metal coins circulate physically (p. 450):

Gold must be in the cash holdings of everybody. Everybody must see gold coins changing hands, must be used to having gold coins in his pockets, to receiving gold coins when he cashes his pay check, and to spending gold coins when he buys in a store.

This might seem at first to be the definitive Misesian endorsement of circulating metallic coins. Yet as Hülsmann notes in this context, “Mises had not become a gold bug. He had no fetish about the yellow metal or any other metal” (Last Knight, p. 922). Hülsmann then points us to the reasons behind Mises’s proposal—to help counteract the advance of inflationary policies (TMC, pp. 451–52):

What is needed is to alarm the masses in time. The working man in cashing his pay check should learn that some foul trick has been played upon him. The President, Congress, and the Supreme Court have clearly proved their inability or unwillingness to protect the common man, the voter, from being victimized by inflationary machinations.

The function of securing a sound currency must pass into new hands, into those of the whole nation [world?]…Perpetual vigilance on the part of the citizens can achieve what a thousand laws and dozens of alphabetical bureaus with hordes of employees never have and never will achieve: the preservation of a sound currency.

At this point, much appears to hinge on the definitions of “good” and “commodity.” Must they necessarily maintain their historical associations with tangibility? It is therefore to tangibility, and in particular its relationship with scarcity, that we now turn. Against all the temptations to try to drop Bitcoin into one old basket or another, can Bitcoin nevertheless stubbornly hold out and demand recognition as something new in the world?

[Intermission]

Part II: The Sound of One Bitcoin

That intangible sense of scarcity

What a difference a few days can make.

What a difference a few days can make.