Many observers have likened the rise of Bitcoin to an asset bubble. It is so customary today to use the “bubble” word in articles about Bitcoin that there may in fact be a sort of “bubble” bubble.

Another less common word introduced in this context is hyper-deflation. Some say such a thing is horrible, others that it is great. I suggest a quite different possible interpretation of these events and a word to label them: hyper-monetization.

I first heard the term “hyper-deflation” (used in a positive sense) when Bitcoin was rising rapidly from the low thirties to the high thirties over a few days in early March (Yes, this was only a month ago). While a few specialists of a certain persuasion understand “deflation” to be a great thing for ordinary people (see, for example, my 30 March 2013 post, “A short Bitcoin commentary on Deflation and Liberty”), the word still has a public-relations problem. Along with some technical issues from its several possible definitions (price level changes versus quantity of money changes, for example), and negative interpretations in conventional economics circles, it just sounds depressing, regardless of the stated technical sense in which one attempts to use it.

The word “hyper-monetization” first occurred to me around that time as a more positive term, and perhaps a more accurate antonym for the catastrophic hyperinflations that have repeatedly killed off fiat paper monies throughout their history. A related term, “de-monetization,” denotes the process of a widely used medium of exchange ceasing to function as such.

A total hyperinflationary collapse is one way de-monetization can happen. Another type of historical example of de-monetization is “bimetallist” legal tender price-fixing schemes driving one precious metal, say silver, out of circulation in favor of another metal, say gold. Yet another historical example is when a pure fiat paper standard is created after monetary authorities permanently “suspend redemption” of their legal tender notes into the precious metals they had promised to deliver.

The opposite process of “monetization” denotes something that was not a money beginning to function as one. When euros took over the respective jobs of various European national currencies, euros monetized and the previous national currencies de-monetized. Now they are historical paper relics, but no longer function as monies.

In contrast to such a legal tender conversion/transition, however, something that gains exchange value from scratch on the open market (rather than taking up exchange value through a conversion)—and does so at a logarithmic pace—might then reasonably be described as being in a process of “hyper-monetization.”

The trouble with the “bubble” bubble

Bitcoin’s high historical and current price volatility is unquestioned. However, one problem with the “bubble” analysis is that in an asset bubble, certain fundamental matters are quite different. In a business cycle mania phase, prices of the most popular asset classes for that particular cycle are bid up as people pile their freshly printed fiat money and freshly produced fiat bank account digits into booming fields. Each party in this rush competes with all the others to acquire some of the bubbling assets. These people are misled by artificially low interest rates to bid up certain asset prices unsustainably, and this all eventually collapses, as described in Austrian business cycle theory.

However high the prices of bubble assets go, they do remain the same goods. In the case of a monetization event, though, the practical use-value of the trading unit (not only its price in terms of other goods or monies) actually does rise with the number of people using it and the depth of the market. To imagine how different this is from a classic asset bubble, it would be as if not only the price of bubble-era houses were rising, but also that their actual sought-after qualities as houses were improving spontaneously at the same time. Such houses might sprout new rooms with no one building them, with new paint jobs appearing mysteriously overnight without any painters having visited.

In this way, quite unlike the case of an asset bubble, the more people “pile into” a medium of exchange, the more valuable it actually is in its function as a medium of exchange from the point of view of its users. This is a separate matter from its price, as a few astute observers out there have so far already been noting.

This type of value has been likened to the use-value of a language rising the more people there are who can speak it. Another analogy would be to the use-value, from the point of view of each user, of a given social networking site rising the more people join it and the more they use it.

These are called network effects. In this case, the exchange value of the unit for each holder is directly related to each holder’s expectations of being able to use the unit in future exchanges (much like the value of knowing a language relates to one’s expectation of being able to communicate with it). This is in turn related to how many people accept the unit, how readily, and for what. It is important here to note, due to long-standing and common economic misconceptions, that the “future” in this sense is any future time—from five seconds from now to however many vaguely numbered years into the future a particular acting person might happen to have in mind.

When it comes to network-effect growth, the more the merrier. An analogy can be made not only to the rising stock price of a growing social networking site, but also, and more importantly, to the number of users of that site and how much it is used.

Check this box for a perspective shift

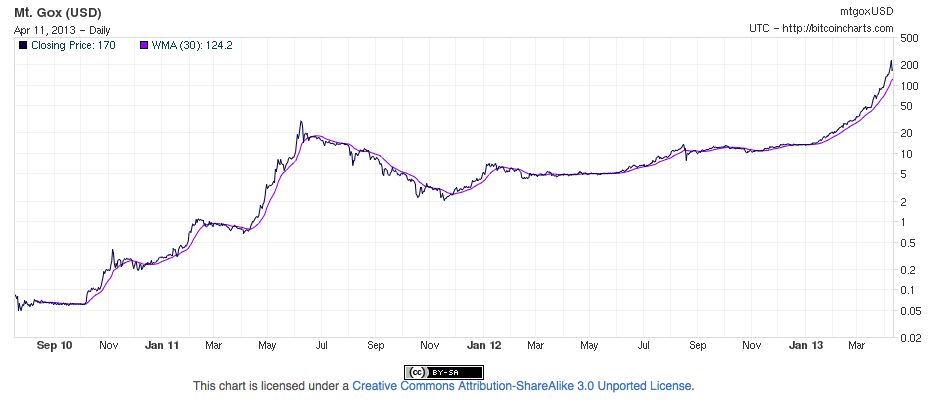

Yesterday, I saw a tweet from the insightful Bitcoin watcher Jonathan Waller. He wrote (enthusiastically, I think) that, “The bitcoin all-time chart is not even slightly sensible,” and linked to a chart [showing logorithmic growth shown on a linear scale].

This tweet got me thinking (yes, this is also a possible function of tweets). How can we make sense of this trend? Might taking some other perspective help?

This chart struck me as looking quite similar to a hyperinflation. However, instead of the exchange value of a trading unit plummeting toward the abyss as in an archetypal fiat paper-money collapse, Bitcoin has been doing the opposite.

Checking the log-scale box on the bitcoin price chart reveals a different picture. It shows a (so far) intuitively ascertainable long-term historical course with a large bump or two and some curves in the road. In this longer-term view, the exchange rate has been growing, not so much from one to two to three to four, as on a linear scale, but from 0.1 to 1 to 10 to 100. It has grown by several orders of magnitude during these couple of years.

Of course, the usual caveats must be quickly noted. “If present trends continue” can and often is infamously followed by them not doing so. But what might nevertheless be observed about this trend?

If one were somehow witnessing a phase in the first “hyper-monetization” in history, is this not more or less what one would expect to see?

Mark my words